🔥 This offer expires in:

🔥 This offer expires in:

+1-888-540-0061

For Renters Who Think They Can’t Afford a Home—But Actually Can

How to Access the $2.5 Billion In Free Money to Buy a Home And Stop Renting in Today

Most renters think they need $50,000 saved to buy a home. The truth? You could qualify with little to nothing out of pocket—and even walk away from the closing table with money in your pocket.

This guide shows you how to access one of the most underused homeowner benefits in America: 2,500+ down payment assistance programs giving out billions each year to buyers just like you.

4.8 / 5 based on 1,931 reviews

PHIL LEADS

TEACHER & DAD OF 1

"I genuinely thought I had to wait another 2–3 years to buy a home. I’d been saving, paying rent on time, and scrolling Zillow every night — but I just assumed I needed $50,000 in the bank to even start. No one ever told me that there are programs offering tens of thousands in assistance — and that I already qualified.

This guide broke it all down. No jargon. No fluff. Just facts. Within weeks, I was preapproved, matched with a $17,000 down payment grant, and I closed on my first home with $0 out of pocket. What’s wild is that I could’ve done this a year ago — I just didn’t know it was possible."

INTRODUCING THE FREE CASH-TO-KEYS™ PDF

90% of Renters Are Missing Out on This — I Almost Did Too

Still Think You Need $20k, $50k, or More to Buy a Home?

Every year, millions of renters stay stuck—

not because they can’t afford a home, but because they’ve been misled. They believe they need a 20% down payment. They think only perfect-credit buyers get approved. And they’ve never heard of the 2,500+ assistance programs

giving out $2.5 billion annually in grants, forgivable loans, and tax credits.

In reality, many first-time buyers get approved with as little as

3% down—or even $0 out of pocket. Some walk away from closing with money in their pocket, not less in their savings.

But most never find out. Why?

Because no one tells them. Not their landlord. Not their bank. And definitely not the system that profits when they stay renters.

This guide changes that.

Instead of delaying for “someday,” it gives you a clear, no-fluff roadmap to:

✅ Buy sooner with little or no upfront cash

✅ Access public funds you already qualify for

✅ Replace your rent with a mortgage—sometimes for less per month

✅ Finally start building equity instead of paying someone else’s

It’s not about guessing anymore. It’s about knowing the rules—and using them to your advantage.

If you’re earning a stable income, paying rent on time, and have a credit score over 580—you likely qualify today.

The only question left is whether you’ll keep waiting… or start owning.

$ 2.5 Billion Unclaimed Every Year

There are over 2,500 assistance programs offering $2.5 billion+ annually in grants and forgivable loans. Yet 90% of eligible buyers never apply. This guide shows how to claim what’s already available—and use it to buy with $0 down.

Only 17% Know the Truth

Just 17% of Americans know you can buy a home with less than 5% down. That means most people are waiting—while others are already buying.

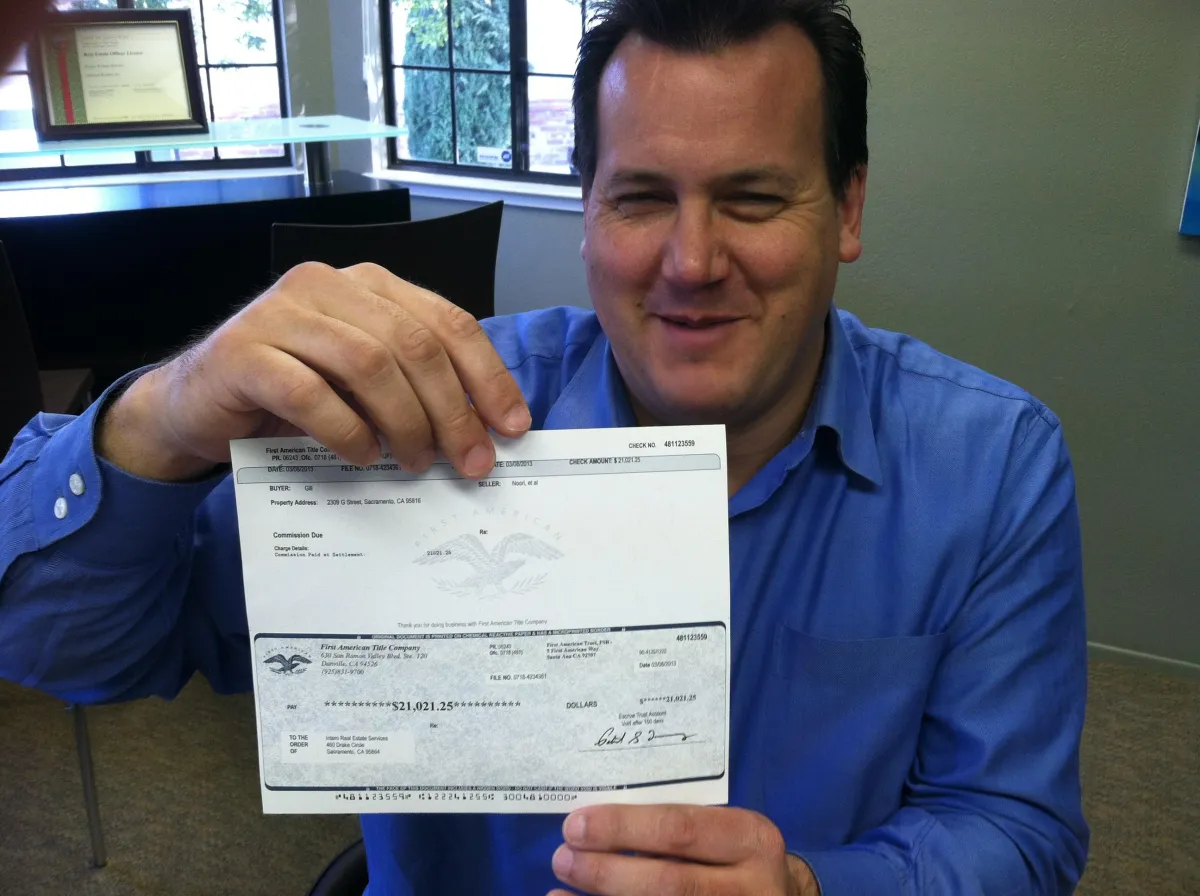

$0 Down. $24K Back. Real Story.

Many programs offer 10–15% of the home price in grants—often enough to buy with $0 down and walk away with extra cash. We break down how real buyers are stacking funds to win big.

81% Want to Buy. Few Do.

81% of renters under 40 want to own—but less than 15% know how. This guide gives you the step-by-step plan no one else is showing you.

MORE THAN JUST A PDF

Knowledge is power. Introducing your superpower...

Right after your purchase, you'll receive all the links to download all 8 of our courses and in just a few clicks!

A Proven System to Help Renters Become Homeowners—Even With $0 Saved

Here's the course content:

Part 1: Break the 20% Down Myth (18 min)

Part 2: Unlock the $2.5 Billion Pool of Free Money (32 min)

Part 3: Get Mortgage-Ready in 30–60 Days (24 min)

Bonus : How Real Renters Are Getting Cash Back at Closing (18 min)

Why Renters Stay Stuck...

Here's the course content:

Part 1: Learn the #1 reason financially qualified renters delay buying (9 min)

Part 2: Seeing the math- understand the assistance (11 min)

Part 3: 70% of U.S. homes qualify for at least one assistance program (34 min)

The Housing Freedom Formula...

Here's the course content:

Intro: What They Never Taught Us About Buying a Home (6 min)

Part 1: DPA 101 — Unlock $10K–$40K You Don’t Have to Repay (36 min)

Part 2: Qualify Even With “Average” Credit and Income (36 min)

Part 3: Use This First Home to Build Wealth Long-Term (32 min)

Launch it! Become Approval-Ready (Without the Stress, Guesswork, or 20% Down)

Here's the course content:

Intro: Why Most Renters Freeze (And How You Won’t) (12 min)

Part 1: Mortgage-Ready in 30 Days or Less (44 min)

Part 2: Preapproval with Power—Even at $0 Down (28 min)

You're Approved: The home-buying cheat code...

Here's the course content:

Part 1: Own a Home Without Saving $30K (25 min)

Part 2: Lock in a Team That Works for You (36 min)

Part 3: Make Offers Like You’ve Bought Before (27 min)

How to Pocket Thousands—Before You Even Move In...

Here's the course content:

Part 1: The Classic Route—Get $0 Down + Peace of Mind (11 min)

Part 2: The Newer, Faster Strategy—Stack Multiple Programs (19 min)

Part 3: The Easiest Way—Use Assistance to Buy + Build Wealth (11 min)

START YOUR MOVE TODAY WITH OUR $9,475+ HOUSING ADVANTAGE BUNDLE - YOURS FOR JUST $44!

4.8 / 5 based on 1,931 reviews

Exclusive Bonuses Just For YOU!

Stop renting. Start owning. No $50K saved. No perfect credit. No guesswork.

We’ve taken the confusion out of the homebuying process and packed everything you need to get mortgage-ready, find assistance, and buy smarter—into one powerful bundle.

This isn’t another “wait and save” strategy.

This is your shortcut to unlocking up to $40,000 in homebuyer assistance and replacing rent with equity—starting right now

BONUS 1: The $24,500 Home Hack™ eBook ($147 Value)

Your step-by-step guide to finding, qualifying for, and using down payment assistance—even if you have little saved or average credit. Includes real-life scenarios, programs by state, and timelines.

BONUS 2: Top 100 Down Payment Assistance Programs ($970 Value)

We've narrowed the field from over 2,000 programs to the most impactful. Find out what’s available in your area—whether it’s forgivable grants, 0% interest loans, or first-time buyer incentives worth up to $40,000.BONUS 3: Mortgage-Ready Document Organizer Template ($79 Value)

No more guesswork. This plug-and-play document checklist helps you assemble everything lenders need—making it easier to fast-track preapproval, qualify for programs, and avoid processing delays.

BONUS 4: First-Time Buyer Closing Cost Calculator + Scenario Sheets ($57 Value)

Customize and run numbers based on your income, home price, location, and grants—so you know exactly what you’ll pay (or get back) at closing. Includes 3 real case study templates.Bonus 5: “Stack & Save” Homebuyer Cheat Sheet ($47 Value)

Learn how real renters are stacking DPA programs, requesting seller concessions, and walking away with $2,000–$5,000+ back after closing—even after putting $0 down.

REAL SUCCESS, REAL PEOPLE

Join Our Community of Success Stories

Verified Review

Alyssa T.

Alyssa T., Mom of Two, Phoenix

“I closed with $0—and I’m a single mom. I always assumed I needed perfect credit and huge savings. Nope. This guide helped me find $21,000 in assistance, qualify with a 612 score, and buy a 3-bed home for my kids—with nothing out of pocket. I went from stuck to homeowner in 60 days."

Verified Review

DAVID CHEN

First-Time Buyer, Denver

“I thought I needed $50K to buy. I needed $0.” I’ve rented for years and assumed homeownership was out of reach. Then I read this guide and learned about down payment assistance I didn’t know existed. I followed the plan, got $17,000 in DPA, and just closed on a $325K home—with $0 out of pocket and $1,500 back after closing. My mortgage is less than my rent. If you think you’re not ready, this will prove you are.

Verified Review

CHRIS AND MONIQUE

Chris & Monique B., Atlanta

"We bought our first home with no savings. We were saving $800/month trying to get to 20% down. This guide showed us how to buy with $0 saved, using state and nonprofit grants. We ended up getting $24,500 in assistance—and our mortgage is less than our old rent. Wish we knew this two years ago."

Verified Review

ROBERT MARTIN

U.S. Army Ret., San Antonio

“I’m a vet. I used VA + DPA and got money back. I had my VA loan but didn’t realize I could layer DPA with it. This guide walked me through the exact process. I got $7K in additional benefits, and walked away from closing with $2,000 back. This is the blueprint every veteran should get."

Verified Review

JASMINE WEBER

College student & part-time worker,

Raleigh

“I qualified with a 590 score—and got approved fast. I assumed my credit would hold me back. Turns out FHA + DPA options start at 580. The lender checklist and DTI walkthrough in the guide made it simple. I just moved into my first place—with help I didn’t know I qualified for."

Verified Review

MICHAEL GONZALEZ

Newlywed, Las Vegas

"I was renting for 8 years. Now I own—and paid less to do it. I thought I had to wait until I had $30K saved. This guide flipped everything. It connected me to a program that gave me $18K in down payment help—and I closed with $0 down. I literally paid more to renew my last lease than I did to own this house."

Want More? Renters Just Like You Send Us This Every Everyday...

4.8 / 5 based on 1,931 reviews

READY TO GET STARTED?

Get The $24,500 HOME HACK™ PDF Today!

Your step-by-step guide to finding, qualifying for, and using down payment assistance—

even if you have little saved or average credit. Includes real-life scenarios, programs by state, and timelines.

The $24,500 HOME HACK ™ PDF

$17 USD

VAT/Tax Include

4.8 / 5 based on 1,931 reviews

Full 74 Page $24,500 Home Hack™ eBook

BONUS 1: 90-Day Homebuyer Action Plan + Tracker ($97 Value)

A printable, plug-and-play roadmap that walks you from “still renting” to “just closed.” Covers every key milestone—preapproval, DPA search, lender questions, documents checklist, and more.

BONUS 2: Lender & Realtor Script Vault ($79 Value)

Don’t know what to say? We’ve got you. Use these word-for-word scripts to:

Ask the right questions (and avoid the wrong agents)

Position DPA confidently when submitting offers

Request seller-paid closing costs

BONUS 3: DPA Program Finder Mini-Course ($297 Value)

Learn how to use free tools to locate assistance programs in your city and state, qualify in minutes, and compare real numbers (like how much you could get: $10K–$40K).

Still Got Questions?

Here's The Answers

What exactly will this guide teach me?

This guide strips away the myths and shows renters how to stop overpaying and start owning—often with $0 out of pocket. You’ll learn: Why you likely don’t need 20% down (and may qualify with just 3%, or none at all) Where to find federal, state, and local Down Payment Assistance (DPA) programs How to qualify even with credit scores as low as 580 How to get closing costs covered—and in some cases, receive money back at closing How to escape the “rent trap” and build wealth through ownership instead of continuing to pay someone else’s mortgage

Is this guide suitable for beginners?

Yes—especially for renters and first-time buyers who feel overwhelmed or misinformed. It’s written in plain English, no jargon, and walks you step-by-step through what to do, when to do it, and how to avoid mistakes that can delay or kill your home purchase. You’ll also get checklists, scripts, timelines, and a full document prep kit to simplify the process.

Do I need a large amount of money to start?

Not at all. The entire premise of this guide is showing you how to get into a home without large savings. Some buyers highlighted in the guide closed with under $1,000—and walked away with checks up to $4,800 back thanks to smart use of DPA and seller credits.

How quickly can I see results?

If you follow the 90-day plan inside, it’s realistic to go from prequalification to keys in hand within 60–90 days. Some buyers in the case studies closed in as little as 49 days after starting with a 580 credit score and minimal savings.

Will this work for me if I have less-than-perfect credit or a non-traditional job?

Absolutely. This guide specifically addresses buyers who: Have credit scores between 580–640 Are 1099, self-employed, or gig workers Think they “make too much” to qualify for help Are worried they’re not the “type” of person these programs are for We walk you through how to qualify and even improve your chances—without scams or expensive credit repair services.

What tools come with the eBook?

Depends on what you purchase but you may receive a full toolkit to take immediate action, including: 90-Day Homebuyer Action Plan + Tracker ($97 Value), Lender & Realtor Script Vault ($79 Value), DPA Program Finder

How is this different from what I can find online for free?

Free advice is often outdated, vague, or full of assumptions that don’t apply to your financial reality. This guide is: Data-backed with real case studies and verified numbers Curated for renters and first-time buyers in 2025 Built for action—not just reading It’s the only resource you’ll need to skip months of research, avoid the wrong lenders, and walk away from closing ahead.

Is there a guarantee if I’m not satisfied?

While we don’t offer refunds on digital products, most buyers tell us they made back the value of the guide within a few days—either through cost savings, lender selection, or assistance awareness. If you follow the action plan inside, you'll walk away knowing exactly what to do, who to call, and how to move forward—without wasting time or money.

4.8 / 5 based on 1,931 reviews

+1 (888) 652-1294

24 Hours

All rights reserved Housing Relief

Disclaimer:

This guide is provided for informational purposes only and does not constitute financial, investment, or legal advice. The content is based on research and personal experience and is intended to share general information about financial concepts and strategies. Individual financial situations vary, and it’s important to consult a qualified financial advisor before making any investment or financial decisions. We do not guarantee specific results, and all investments carry risk. The creators and distributors of this guide are not responsible for any losses or damages resulting from actions taken based on its contents.